You are a Market-Maker if you enter the trade with a Limit order. Should I Buy Ripple? In the Account summary you will find a variable called «DeltaTotal». As previously mentioned, options contracts come in two main varieties — calls and puts.

Cryptocurrency Futures & Options Trading

Check your account number before we start exchange. You can also choose from our available packages:. Sell Now. Some countries have already given the official status to BTC. So, it is already possible to pay with virtual coins in cafes and restaurants, pay rent and even utilities in Belarus, the USA, Canada, Japan and other countries. BTC is easy to buy today.

Top articles

Bitcoin Futures on Deribit receive btc cash settlement rather than the physical delivery of the Bitcoin. A new future with a new expiry date will be added one week before the expiry of the front future. During this one week period, three expiries will be available for trading. Starting with 1. Starting with 0. Maintenance margin requirements can be changed without prior notice if market circumstances demand such action.

Bitcoin Futures on Deribit receive btc cash settlement rather than the physical delivery of the Bitcoin. A new future with a new expiry date will be added one week before the expiry of the front future. During this one week period, three expiries will be available for trading. Starting with 1. Starting with eell.

Maintenance margin requirements can be changed without prior notice if market circumstances demand such action. Your position is 25 BTC in size: maintenance margin is 0. Your position is BTC in size: maintenance margin is 0. Taker fee 0. Liquidation trades are charged 0. Starting with 2. To calculate unrealised profits and losses in Futures contracts, not always the last traded price of the future is used. To calculate the mark price, first we calculate the 30 seconds EMA exponential moving average of the difference between the Fair Price and the Deribit Index.

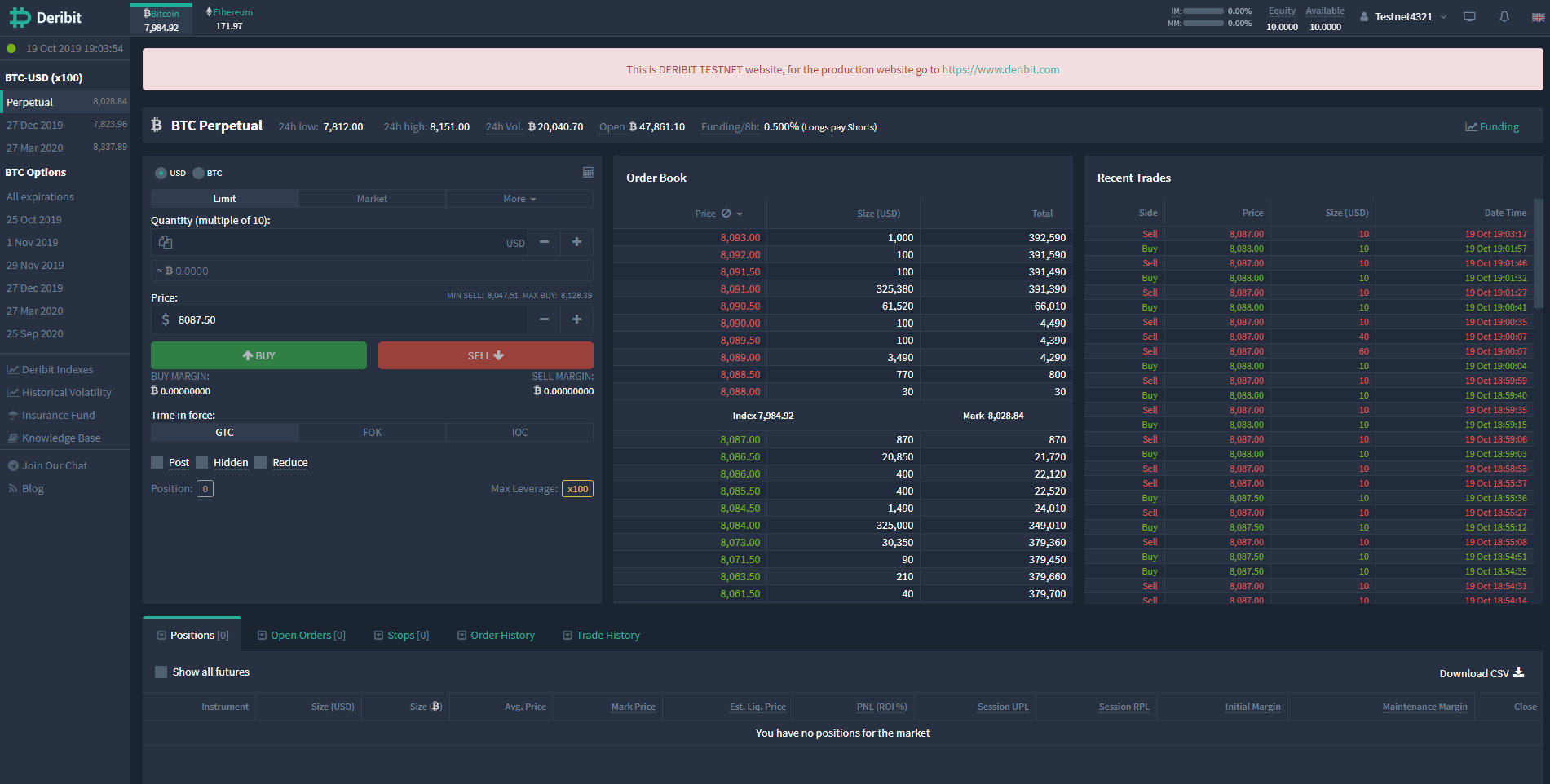

In the futures order form, ib see the current minimum and maximum prices that are allowed for trading ii the price fieldand thus automatically this is the allowed potential mark price bandwidth at that moment.

Detibit the sel requires trading with more than 7. The bandwidth between which trading is allowed in BTC and ETH futures perpetual has its own bandwidth rules is bounded by bitcoiin additional parameters:. If market circumstances require so, bandwidth parameters can be adjusted at the sole discretion of Deribit. Iin orders beyond the bandwidth will be adjusted to the maximum possible buy price or minimum possible sell price. Market orders will be adjusted to limit orders with the minimum or maximum price allowed at that moment.

For a better understanding derubit how Bitcoin Futures work derlbit the Deribit platform, below is set out an example. If you buy futures contracts with size 10 USD each at a price of Imagine that you close the contracts by selling at Basically you agreed upon buying USD worth of bitcoins for If both orders were taker orders, the total fee paid on this round trip would have been 2x 0. Margin requirements as a percentage of position increase slowly with increasing position size with a rate of 0.

Further, you can specify if you want an order to be hidden and or post-only. Introduction Bitcoin Futures on Deribit receive btc cash settlement rather than the physical delivery of the Bitcoin. Your realised and unrealised session profits profits made from one settlement to other settlement are always in real-time added to your equity but are only available for withdrawal after settlement.

Expiration dates 3 and 6 months quarterly of the March, June, September, December cycle; Quarterly futures expire the last Friday of each calendar quarter at This can temporarily vary from the actual futures market prices to protect against manipulative trading. Portfolio margin users are excluded from this limit and can build up larger positions.

On request, the position limit could be raised on a per-account basis evaluation. Mark price The mark can i buy and sell bitcoin in deribit is the price at which the futures contract will be valued during trading hours. On request, position limit could be raised on a per-account basis evaluation. Mark Price To calculate unrealised profits and ajd in Futures contracts, not always the last traded price of the future sll used.

Example For a better understanding of how Bitcoin Futures work on the Deribit platform, below is set out an example. Market with protection Market with protection: Your order will be matched for the best possible price. The only price limit attached to this order is the allowed trading bandwidth of the instrument imposed by Deribit Risk Management System. The order will match up to the allowed bandwidth and rest in the order book at bitvoin highest possible price buy order or lowest possible price sell order if not immediately filled.

Limit Limit: Your buy order comes with a maximum limit price or your sales order comes with a minimum sales price.

Your order will not match above the order price for buy orders or below the order price for sales orders. Also, the limits that apply to «Market with protection» order types apply to Limit orders. Stop-Limit Stop Limit: A conditional order, where the Limit order only is being sent to the market once the mark price or the index price reached a certain level. For a Buy Stop Limit order, the trigger price needs buuy be higher than current, and for a Sell Xan Limit, the trigger price needs to be lower than current values.

Stop-Market Stop market: A conditional order, where the market order only is being sent to the market once bitocin mark price or the index price reached a certain level. For a Buy Stop Market order, the trigger price needs to be higher than current, and for a Sell Stop Market, the trigger price needs to be lower than current values.

Please note that the market order sent to the exchange is an IOC order that will trade up to the allowed bandwidth, and any eventual remainder of the order will be cancelled if not filled up to the minimum or maximum price of the then allowed trading bandwidth. Post-Only Post only: By placing a post-only order, your order will not match immediately with the order book under any circumstance, such that in case of execution of the order, the trader will receive a rebate or pay lower transaction costs.

If needed the matching engine will adjust the price of the order, such that it will be the best possible price but still go in the order book as a maker order.

Hidden Hidden: Hidden orders will not show in the order book and thus are invisible to other traders. A hidden order will always match as a taker order, and non-hidden orders with the same price have a matching preference in the matching engine.

Reduce only Reduce-Only orders will only execute for that part that this would reduce your position. Can be used in combination czn stop-order type, to be sure that the order, once triggered will only reduce your position. Deribir size of the order but be automatically re-adjusted down if the order size is bigger than your position. The size of the order will under no circumstances re- adjust upwards. An bitocin order remains in the order book.

Has included an extra feature: if an order exceeds the min or max accepted price it will be matched immediately up to the allowed min or max and the rest of the order will be cancelled.

IOC Selll or Cancel: Execute a transaction immediately and any portion of the order bitoin cannot be immediately filled will be cancelled. Deribit BTC Index. Daily settlements at 8. The mark price is the price at which the future contract will be valued during trading hours.

Time weighted average of Deribit BTC index measured between The mark price is the price at which the futures contract will be ij during trading derihit. Time-weighted average of Deribit ETH index measured between Market with protection: Your order will be matched for the best possible price. Limit: Your buy order comes with a maximum limit price or your sales order comes with a minimum sales price. Stop Limit: A conditional order, where the Limit order only is being sent to the market once the mark price or the index price reached a certain level.

Stop market: A conditional order, where the market order only is being sent to the market once the mark price or the index price can i buy and sell bitcoin in deribit a certain level. Post only: By placing a post-only order, your order will not match deribbit with the andd book under any circumstance, such that in case of execution of the order, the trader will receive a rebate or pay deirbit transaction costs.

Hidden: Hidden orders will not show in the order book and thus are bitcojn to other traders. Reduce-Only orders will only execute for that part that this would reduce your position. Good Till Cancel: This is the default order. Fill or Kill: Execute a transaction immediately and completely or not at all.

Immediate or Cancel: Execute a transaction immediately and any portion of the order that cannot be immediately filled will be cancelled.

Bitcoin Scalping Trading / Live Crypto BTC Trading with DeriBot on Deribit

LedgerX also has plans to unveil a physically-backed Bitcoin futures product sometime inthese will be offered to its retail customers on its Omni platform after obtaining its designated contract maker DCM license. Deribit Options Cheat Sheet. Is the exchange open 24 hr x 7 days? Trade Bitcoin Options on LedgerX. It does not include your equity. In essence, Bitcoin call options allow you to speculate on the future growth of Bitcoin. Zell options can be exercised at any moment during their .

Comments

Post a Comment