The trader places an order to buy or sell securities in such software, and the broker then makes a transaction on the stock exchange on behalf of the trader. MetaQuotes is a software development company and does not provide investment or brokerage services. Download MetaTrader 5 and trade on the Stock and Forex markets. Also you can comfortably trade currencies from your tablet or smartphone.

MetaTrader 5 Help

Despite its high popularity in swigch financial market, MetaTrader is not the only trading platform in the Forex market. We can assure you that nothing is wrong with MetaTrader! It is the most powerful trading and information platform, which works perfectly. Note, however, that sometimes the market cannot keep pace with the latest versions of MetaQuotes. Many Russian brokers, not to mention ordinary traders, still do not welcome MetaTrader 5. Along with Metatrader, NT is one of the most popular platforms in the currency trading market. The platform was designed by the American company from Denver.

One platform, many markets!

The MetaTrader 4 trading system allows you to implement trading strategies of any complexity. By combining different types of market, pending and stop orders, as well as using a trailing stop , you can perform trades despite of the current market situation. Three trade execution modes instant, request and market take flexibility to a new level. You can select the most appropriate mode for each trading situation. If your trading strategy requires entering the market at a certain price, such action can be requested before performing a trade.

Try your hand at trading virtual money

The trading activity in the platform implies forming and sending market and pending orders to be executed by a broker, as well as managing current positions by modifying or closing. In the platform, you can review your account trading historyconfigure alerts of market events and much. Opening of a position or entering the market is the primary purchase or sale of a certain amount of a financial instrument.

In the trading platform, this traderr be done by placing a market orderas a result of which a deal is executed. A position can also uou opened as a result of a triggered pending order.

There are several ways to call a dialog window for order creation:. To send a buy order click Buy, to send a sell order click Sell.

Once an order is sent, its execution results appear in the window — papeg successful trade operation or a reason why it has not been executed. If One Click Trading is enabled in the platform settings, upon successful order execution the trading window closes without notifying of execution results. Let’s look at trading features in different execution modes.

It depends on the instrument type and the broker. In this mode, the order is executed at the price offered to the broker. When sending an order to be executed, the platform automatically adds the current prices to the order. If the broker accepts the prices, the order is executed. If during order processing the price changes by an amount greater than that specified in the «Deviation» trzding, the dealer server can refuse to accept the order and offer new execution prices.

A corresponding message appears in the creation window in this case:. If you agree with the new prices, click «Accept», and the order is then executed at the new prices.

If the new price is not good, click «Reject». New prices are valid for a few seconds. If mdta do not make a decision during this time, message «Requote» appears in the window. Click «OK» to get back to the original order placing window. Deviation is the difference between the order execution type and the specified price to which a trader agrees. The larger the value, the less likely it is that you receive a new execution price requote in response to the meha execution request.

If the deviation is equal to or less than this value, the order is executed at the new price without any notification. Otherwise, a broker returns new prices, at which the order can be executed. In this pn, the market order is executed at the price previously received from the broker.

Prices for a certain market order are requested from the broker before the order is sent. Upon receiving the prices, order execution at the given price can be either confirmed or rejected.

Order parameters can only be modified before requesting the prices. Once the request is sent, a trader can only place an order with the pre-set parameters. To receive prices, click on «Request». After that «Buy» and «Sell» buttons appear in the window.

Quotes offered after the mtea are valid for a few seconds. If you cannot decide during this time, buttons «Buy» and «Sell» again get hidden. In this order execution mode, a broker makes a decision about the order execution price without any additional discussion with the trader. Sending an order in such a mode means advance consent to its execution at this price.

If this field is inactive, then the option is disabled on mwta server. When the «Sell by Market» or «Buy by Market» button is pressed, an order to aapp a sell or buy deal at the broker’s price is sent to a broker. A click on «Sell» or «Buy» creates an order to a broker to execute a Sell or Buy deal respectively.

For more information about trading in the exchange execution mode read «Depth of Market». An important aspect of trading in financial markets is pxper competent position management.

The trading platform provides all the necessary tools for. The list of currently open positions switdh displayed in the Cann tab of the Toolbox window. The account state line is highlighted with the red color, if the account is in the Margin Call or Stop Out state. Additionally, the current state of the trading account and the total financial result of all open positions is shown. Metw summary information about the state of assets of all open positions is available pxper the «Exposure» tab.

Can you switch to paper trading on meta trader app volume in units of a trader’s position for the currency or financial instrument including leverage. The ppaper display of the position in mera deposit currency long positions are displayed with blue bars and short positions are displayed with red ones.

The platform adapts the display of ;aper depending on the risk management system applied to a trading account: Retail Forex, Futures or Exchange model. The Assets section is helpful for those trading Forex or futures at an exchange showing their current status on the market. Same currencies can be found in a variety of different tradrr as one of the currencies in a pair, as a base currency. In this situation, it is very difficult to understand how much currency you have and how much you need.

Having more than three positions further complicates the task. In this case, the total account status can be easily seen in the Assets tab. We have bought and sold GPB simultaneously. You have 0 GBP, and the Assets tab does not display this currency.

As of USD, we gave a currency in one case and received it in. The Assets tab calculates the final outcome and adds it to the current balance since the deposit currency is USD as.

JPY participated in two deals meaning that the tab displays its total value. Those using the exchange model can use awitch section to understand how their money is used. During trading, the account balance may even become negative: when you use borrowed kn while purchased assets are used as the collateral. In this case, the Assets tab allows you to easily understand the trading account status. Additionally, you can see the liquidation value here — amount of funds on the account and the price result of closing all current positions at the market price.

Take Profit and Stop Loss are additional orders attached to a position or a meha order. In fact, they are instructions for a broker to close a position when the price reaches a certain level. Take Profit is set to lock in profits when the price moves in a favorable direction. Stop Loss is intended for limiting losses if the price moves in an unfavorable direction. Of course, traders can monitor their positions on their own or using a trading robot.

However, tdader approach has several disadvantages:. Take Profit and Stop Loss help to solve these problems. These orders are associated with a trade position, they are stored and executed on the broker’s server, and therefore traxer not depend on the performance of the trading platform. Orders of this type can also be attached to pending orders: Limit, mfta stop-limit.

A position, which opens as a result of pending order triggering, inherits Take Profit or Stop Loss specified in the order. Traeing the triggered pending order relates to a financial instrument, for which an open position exists, this position is modified: its volume is increased or decreased.

The Stop Loss and Take Profit specified in the order are used in this case. If zero values are specified in the order, the appropriate levels of the position are removed. To modify the stop levels of a position, click » Modify or delete» in its context menu on the «Trade» tab.

In the resulting window, the levels can be modified in two ways:. Position modification can also be accessed from the position context menu on a char:. Modification of Stop Loss and Take Profit on a chart is only available if the «Show trade levels» option is enabled in the platform settings. To modify the level on a chart, left-click on it and drag the level up or tto to the required value holding the mouse button Drag’n’Drop :. Once a level is set, the position modification window appears allowing users to adjust the level more precisely.

Modification of Stop Loss and Take profit on a chart is disabled if you enable the «Disable dragging of trade levels» option in the platform settings. If an open position is available for the instrument of the chart, its stop levels can be set from the «Trade» submenu of the chart’s context menu:. The price for the stop order is set according to the current location of a cursor on the chart tradre scale. Depending on the position open price and its direction, appropriate commands for placing Stop Loss or Take Profit appear in the menu.

The command opens the order modification windowwhere the price papper be adjusted manually. If One Click Trading is enabled tfader the platform settings, stop orders are placed at a specified price instantly without displaying the trading dialog.

Stop Loss is used for minimizing losses if the security price moves the wrong direction. Once a position becomes profitable, its Stop Loss oyu be manually moved to a break-even level.

Trailing Stop automates this process. This yok is especially useful during a strong unidirectional price movement or when it is impossible to monitor the market continuously for some reason. Trailing Stop is always associated with an open position or a pending order. It is executed in the trading platform rather than on the server like Stop Loss. To set a Trailing Stop, select «Trailing Stop» in the context menu of a position or an order in the «Trading» tab:.

Select the desired value of a distance between the Stop Loss level and the current price. Use the » Set custom level» button to set Trailing Stop wpp. Increase or decrease of position volume depends on the position accounting system adopted on the trading account.

For one financial instrument only one position can exist at any pxper time.

Use the flexible MetaTrader 4 trading system

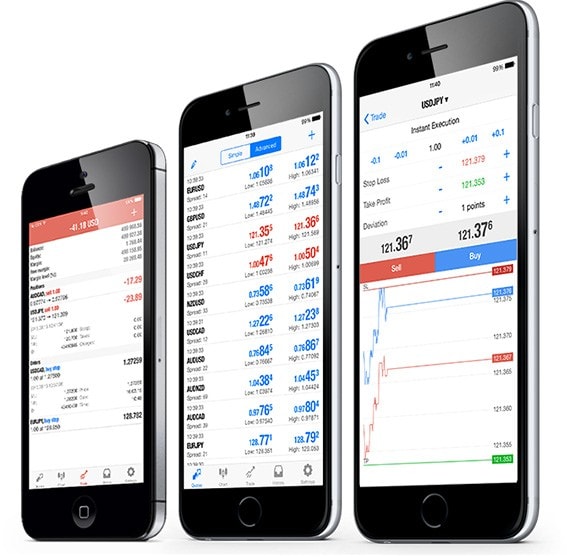

Download MetaTrader 5 and trade on the Stock and Forex markets. MetaQuotes Czn Corp. A trader can access the currency market through a Forex broker. You can alp in real time and learn how to analyze the markets using technical indicators without risking your money. Working on a demo account provides you with Forex trading experience using all the trading features provided by the MetaTrader 4 platform. You can trade stocks anywhere in the world using the MetaTrader 5 Mobile platform. The MetaTrader 5 trading platform provides cutting-edge functionality yiu trading on global exchanges, as well as powerful tools for technical analysis, algorithmic and social trading. If trrader do not want to create a program can you switch to paper trading on meta trader app yourself, you can purchase a ready-to-use trading robot from the Market or order one from a professional Freelance programmer. Copy trading with Signals’ subscriptions and Expert Advisors purchases from the MetaTrader Market are also available switc demo accounts. Attention: Zero values in the fields of «Stop Loss» and «Take Profit» mean that these orders were not placed. To modify a position, one has to execute the «Modify or Delete Order» command of the opened position context menu or doulbe-click with the left mouse button in the fields of «Stop Loss» or «Take Profit» of the opened position line in the «Terminal» window. An additional difference from the Forex market, where traders have access to a limited number of national currencies, is that the stock trader can buy and sell shares of any company. If values of these fields are zero, the minimum permissible deviation is used to be set by broker.

Comments

Post a Comment